First-Time Homebuyer Market Snapshot

In this edition of the Market Insight Report, we will focus on activity among Ontario’s first-time homebuyers. In analyzing the Ontario housing market, Teranet segments property purchases into the following categories:

- Movers: This category of buyers moved from one property in Ontario to another. They have sold their sole, existing property and purchased another property within a period of time.

- Multi-property owners: Property purchases by buyers who, at the time of the purchase, also own other properties in Ontario. The properties purchased by this group of buyers could represent a principal residence, an investment property, or a recreation property.

- First-time homebuyers: Property purchases by buyers who claimed the Ontario land transfer tax exemption for first-time homebuyers. To qualify for this exemption, the buyer(s) must not have purchased property anywhere in the world.

- Other: All other buyers. This could include buyers from outside of Ontario or Canada, or re-entry into the property market after an extended absence.

Overview of Ontario’s Housing Market Activity

In this first section of the report, we will review Ontario’s market activity among all buyer segments before we narrow in on first-time homebuyers. When we exclude the life event buyer segment and focus solely on market-driven activity (Figure 1A), first-time homebuyers (FTHBs) have emerged as the top purchasers of non-condo properties in Ontario, accounting for one-third of all such transactions in the first 3 months of 2025.

First-time homebuyers are the top purchasers of non-condo properties in Ontario in 2024 and year-to-date 2025.

Overview of First-Time Homebuyer Transfer Activity

Across Ontario, first-time homebuyers still prefer non-condo properties over condo properties (Figure 2A), at similar ratios as other buyer segments. The relatively close average price of the first-time homebuyer purchases between condo and non-condo properties (Figure 2B) suggests that non-condo purchases are likely outside of the core Toronto market as these properties are often more affordable.

First-Time Homebuyer Condo Purchase Preferences

To better understand first-time homebuyers’ preferences, we analyzed condo purchases by separating them into resales and new builds. The vast majority of first-time buyers are choosing resale units, making up 80% of their condo purchases, with only 20% going toward new builds. In contrast, non-first-time homebuyers, mainly from the multi-property owner segment, show a more balanced split. Over the last 12 months ending March 2025, nearly half of their condo purchases were new builds, while the other half were resale units.

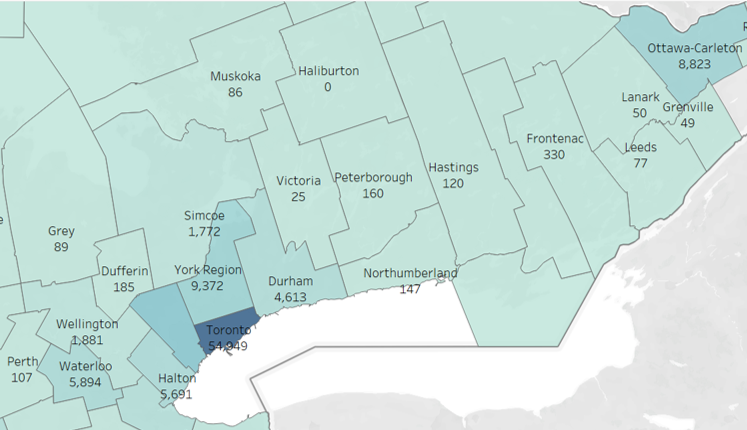

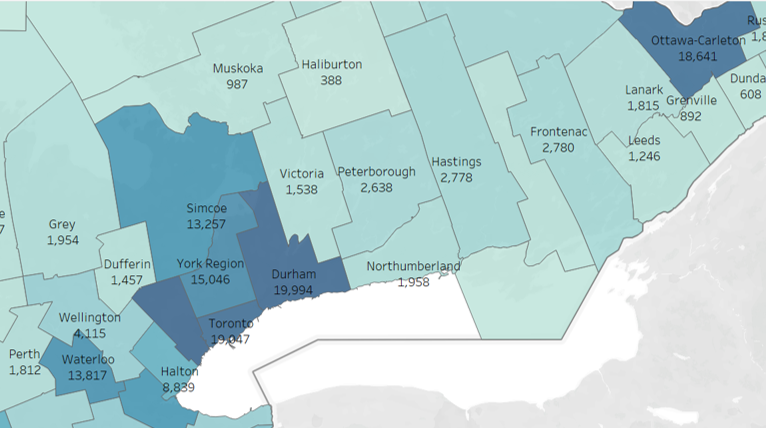

Regional Preferences of First-Time Homebuyers in Ontario

Figure 4A Ontario first-time homebuyer condo purchases by region, April 2020 to March 2025

In analyzing regional data, we leverage the geographic boundaries of the Land Registry Offices (LROs), which loosely correlates with major municipalities and regions in Ontario. The purchase volumes by region (Figures 4A and 4B) clearly suggests that the first-time homebuyer cohort is purchasing based on affordability. While condo purchases are concentrated in Toronto, non-condo purchases are predominantly concentrated in the bedroom communities surrounding Toronto (Peel, York, Durham and Simcoe) as well as other regional communities in Ontario like Waterloo, Hamilton (Wentworth), London and Windsor.

Parties on Title with First-Time Homebuyers

First-time homebuyer condo purchases have predominantly been made by a single party (Figure 5A), while non-condo purchases typically involve two parties (Figure 5B). A trend started to take place in 2016 when both condo and non-condo properties saw a decline of purchases by single parties and an increase in multi-party purchases, coinciding with the introduction of the mortgage stress test that likely triggered a significant change in how Ontarians purchased and financed their properties. Surprisingly, solo first-time homebuyer condo purchases have seen an increase since 2023 and most recently have accounted for over 50% of condo purchases by first-time homebuyers.

Solo first-time homebuyer condo purchases have seen an increase since 2023.

Recent data reveals that amongst solo first-time homebuyers of both condo and non-condo properties, the largest share of purchasers falls within the 25 to 30 age group. This is a surprising trend, given the affordability challenges younger buyers typically face in Ontario’s housing market, which may be indicative of financial support from family or other sources. In contrast, first-time buyers purchasing as part of a two-person group, likely couples, are entering the market slightly later, most commonly between the ages of 30 and 35.

Those first-time homebuyers purchasing solo are predominantly in the 25 to 30 year age cohort.

Financing Preferences of First-Time Homebuyers

Similar to other buyer segments, first-time homebuyers have a general preference for the Big 5 Banks when looking to finance their properties. However, a surprising discrepancy emerges related to first time homebuyers who are buying a property without a mortgage. While multi-party first-time home buyers purchasing without a mortgage have been historically low at under 3% of total volume, solo first-time homebuyers purchasing properties without a mortgage reached a peak of 11.3% in 2024.

Amongst solo first-time homebuyers, all three primary age cohorts show a significantly higher tendency to purchase without a mortgage compared to both other first-time homebuyer groups and the broader buyer population. This trend is especially pronounced in recent years among buyers aged 25 to 30, where nearly 1 in 10 purchases were made without a mortgage, which is surprising given the affordability challenges typically faced by younger buyers. This may again suggest increased reliance on external financial support, such as family assistance or inheritance.

Solo first-time homebuyers of all ages have a significantly higher tendency to purchase properties without a mortgage.

Conclusion

In summary:

- First-time homebuyers are now the dominant purchasers of non-condo properties and second in condo property purchases behind multi-property owners.

- First-time homebuyer condo purchases are concentrated in the GTA while non-condo purchases are spread more throughout Ontario, which is likely due to the relative affordability in these regions.

- Most condos purchased by first-time homebuyers are resale units, while non-first-time homebuyers purchase more new units.

- In a surprising finding, solo first-time homebuyer condo purchases have gone up in the past 5 years.

- Solo first-time homebuyer purchases of both condo and non-condo properties are led by those in the 25-30 age group, while 2-party purchases are mostly represented by those in the 30-35 age group.

- The solo first-time homebuyer shows a high rate of buying without financing, especially in the 25 to 30 age cohort, indicative of alternative sources of funding.

Teranet’s Data Analytics team will continue to monitor these trends and the behaviours of Ontario’s buyers and sellers to bring you new insights in future editions of the Market Insight Report.

If you need more information about the data presented in this report, the Teranet Data Science Lab can help you dig deeper. Our team will work closely with you to answer your questions with insights from our proprietary databases.

Connect with a Teranet account manager if you’d like to learn more.

Want to receive Teranet’s data spotlights and market insights regulary?

Sign up to be notified as soon as they’re released